Reversal Patterns

Reversal patterns are those chart formations that signal that the ongoing trend is about to change course. Reversal patterns show a strong likelihood that the current trend has ended and that there is a significant chance that the trend will reverse direction.

If a reversal chart pattern develops during an uptrend, it suggests that the trend will change and the price will shortly start to decline.

On the other hand, a reversal chart pattern during a downtrend indicates that the price will rise later on.

With relatively small protective stops, they provide entry signals early in the development of a new trend, making their entries particularly attractive. However, the trend might not change direction right away and would instead establish a trading range.

There must be an existing trend that is to be reversed, much like with continuation patterns. Reversal patterns are invalid in the absence of an established trend.

Common Types of Reversal Patterns

Reversal patterns may be identified in all time frames, with the most common reversal patterns being:

- Double Top

- Double Bottom

- Head and Shoulders

- Inverse Head and Shoulders

- Rising Wedge

- Falling Wedge

- Rounding Top

- Rounding Bottom

To trade these chart patterns, simply place an order beyond the neckline and in the new trend's direction. Then go for a target that’s almost the same as the height of the formation. For instance, if you see a double bottom, place a long order at the top of the formation’s neckline and go for a target that’s just as high as the distance from the bottoms to the neckline.

In the interest of proper risk management, don’t forget to place your stops! A reasonable stop loss can be set around the middle of the chart formation. For example, you can measure the distance of the double bottoms from the neckline, divide that by two, and use that as the size of your stop.

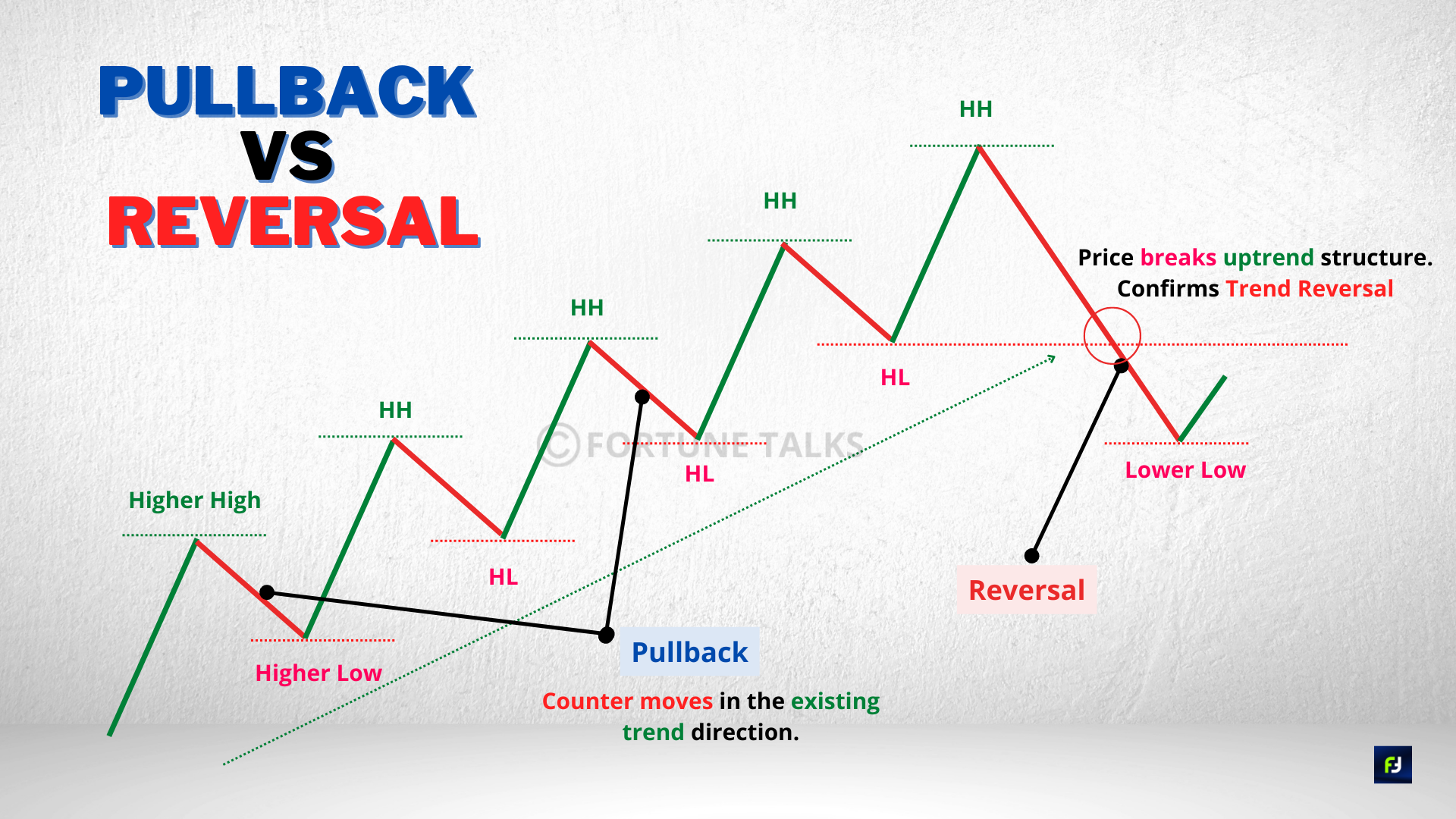

A Reversal and a Pullback

A reversal is a shift in the price of an asset's trend. A pullback is a counter-move within a trend but does not change the direction of the trend. Higher swing highs and higher swing lows indicate an uptrend. The higher lows are produced by pullbacks. Therefore, unless the price establishes a lower low in the time frame the trader is monitoring, there is no reversal of the uptrend. Always, reversals begin as prospective pullbacks. When it begins, nobody knows which one it will eventually be.

Challenges of Reversals

It might be difficult to tell whether a reversal or pullback is beginning. The price may have gone quite a distance by the time it becomes clear that it is a reversal, causing the trader to sustain a substantial loss or loss of profit. Because of this, trend traders frequently sell their positions while the price is still going in their favor.

False signals are a common occurrence. An indicator or price action may show a reversal, but the price instantly resumes moving in the previous prevailing direction.

إرسال تعليق